Massachusetts pioneered Western paper currency in 1690, issuing £7,000 to address financial crises during King William's War. You'll find that before paper money, the colony relied on their famous Pine Tree Shillings, minted from 1652, featuring evolving designs from simple "NE" markings to detailed pine tree motifs. The colony's currency system included both paper denominations (5s to £5) and metallic coins, with carefully crafted anti-counterfeiting measures like unique cut patterns. The economic backbone relied heavily on fur trade and Spanish silver, while British influence later shaped strict currency reforms. This fascinating monetary evolution holds countless stories of colonial innovation and financial experimentation.

Key Takeaways

- Massachusetts issued America's first paper money in 1690, printing £7,000 to solve financial problems after a failed military campaign.

- The Pine Tree Shilling, minted from 1652, was Massachusetts' primary silver coin featuring distinctive tree designs to prevent counterfeiting.

- Early Massachusetts currency included alternative forms like bullets and seashells due to frequent shortages of official coins.

- Paper money in Massachusetts faced value fluctuations, with a 34-fold increase between 1703-1713 leading to significant inflation.

- The colony returned to silver and copper coins in 1749 after receiving metal payment from Britain for military support.

First Steps Into Paper Money

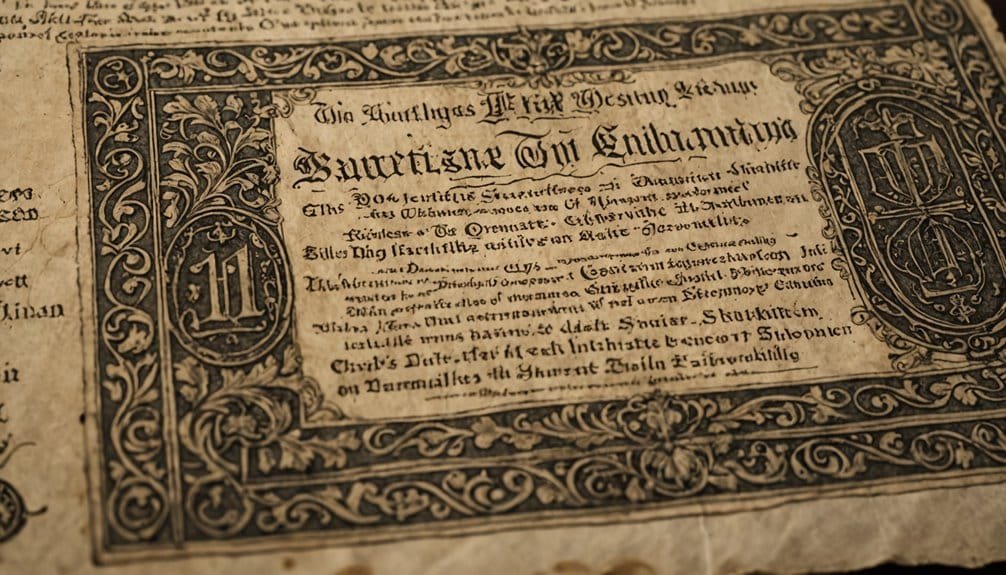

When did America's journey into paper currency begin? The origins of American paper money can be traced to December 10, 1690, when Massachusetts Bay Colony made a groundbreaking decision in colonial finance.

You'll find that the Massachusetts General Court authorized the first public paper money in the Western world, issuing £7,000 to address an urgent financial crisis.

The colony needed to pay its soldiers and creditors after a failed military expedition during King William's War. You're looking at a currency that featured the Massachusetts Bay Colony seal, carried signatures from three committee members, and came in denominations of 5s, 10s, 20s, and £5. These bills were designed with unique cut patterns to prevent counterfeiting.

The Story Behind Metallic Coins

Three significant events marked Massachusetts's venture into metallic currency, beginning with the establishment of the Boston mint in May 1652. Under John Hull and Robert Sanderson's supervision, the mint operations produced shillings in three denominations, featuring evolving coin designs from simple "NE" markings to sophisticated pine tree motifs. The coins' value experienced significant depreciation over time due to inflation and economic pressures.

| Period | Significant Development |

|---|---|

| 1652-1682 | Original Boston Mint Operation |

| 1652 Design | NE Simple Markings |

| 1652-1660s | Willow/Oak Tree Series |

| 1667-1682 | Pine Tree Design Era |

You'll find these coins were deliberately dated 1652 to appear compliant with English law, though produced later. The pine tree design symbolized Massachusetts's valuable mast timber exports. The coins circulated widely throughout North America and the Caribbean, though at values below their British sterling counterparts. In 1786, Massachusetts launched its second coinage effort, producing decimal-based copper coins under state ownership.

Understanding Early Trade Methods

Beyond Massachusetts's early experiments with coinage, the colony established a sophisticated network of regulated trade that shaped its economic foundation.

You'll find that the fur trade formed the backbone of early commerce, with colonial regulations requiring specific trading licenses for merchants who dealt with Native populations. These annual licenses commanded substantial fees, reflecting the trade's profitability and importance to colonial authorities. The system centered on peltry commodities, particularly beaver skins, which proved essential for debt repayment and economic growth.

Regional traders like William and John Pynchon dominated these early agreements, operating under strict colonial oversight that prohibited trading firearms and liquor to natives.

The Connecticut Valley emerged as a significant hub, where Native interactions were carefully managed through licensed merchants.

You'll notice how these trading licenses reflected the colony's dual concerns: maintaining profitable commerce while controlling the exchange of sensitive goods with indigenous populations.

Colonial Currency Value Changes

Massachusetts's complex monetary history exemplifies dramatic currency value fluctuations throughout the colonial period, beginning with the 1652 silver coinage that deliberately reduced the British sterling standard by 22%.

You'll find that currency depreciation became particularly evident after 1690, when paper money entered circulation, leading to a staggering 39% annual increase in currency stock over the following decade. The transition from the earlier barter system had made such monetary policies necessary for standardized commerce.

The inflation impacts were significant, though initially moderate. While paper currency quantity increased 34-fold between 1703 and 1713, silver's price in Boston rose only from 7 to 8½ shillings.

You'll notice varying exchange rates across colonies, with Massachusetts valuing Spanish dollars at 72d in 1683, increasing to 74d by 1693.

The situation became so severe that by 1749, Massachusetts withdrew its paper money entirely, returning to specie to combat rampant depreciation.

British Influence on Money Reform

Britain's substantial influence on Massachusetts currency reform became evident when you examine the 1749 shipment of two tons of Spanish silver and ten tons of British copper coins, sent as reimbursement for colonial military aid.

You'll notice London's direct intervention intensified through Parliament's September 21, 1751 act, which severely restricted Massachusetts' ability to issue paper money.

The Crown's anti-inflation strategy required you to understand how Massachusetts ultimately complied with British demands, redeeming outstanding paper notes and returning to specie currency between March 1750 and March 1751. Thomas Hutchinson's law proposed using £183,649 from the Louisbourg expedition to help fund this currency redemption effort.

Silver Shipment From Britain

In accordance with British imperial policy, the Crown sent a substantial shipment of silver and copper coins to Massachusetts Bay Colony in 1749, marking a pivotal moment in colonial monetary reform.

The General Court's authority over monetary matters had historically influenced such reforms, following decades of currency management experience. You'll find the silver significance reflected in the massive delivery of two tons of Spanish silver dollars and ten tons of British coppers, valued at over £183,649 sterling.

This currency shift proved instrumental in implementing the 1749 reform act, which mandated the redemption of all paper notes between March 1750 and March 1751.

You'll see how the influx of hard currency, particularly Spanish 8 reales, helped stabilize the economy by providing a reliable medium of exchange at a fixed rate of 6 shillings per Spanish dollar, effectively curtailing the inflation that had plagued the colony's paper money system.

Royal Currency Reform Orders

Through a series of stringent parliamentary acts, Britain's Crown authorities sought to rein in colonial monetary policies, beginning with the pivotal Currency Act of 1751. You'll find these reforms targeted currency stabilization by restricting paper money emissions and legal tender status, particularly in New England colonies.

The Crown's intervention intensified with the 1764 extension, which applied these restrictions across all North American colonies. Britain's attempts at monetary control sparked significant economic tensions. The initial fears of trade collapse proved unfounded, as trade flourished after the adjustment period.

You'll notice how colonial governments faced mounting pressure as the scarcity of gold and silver complicated daily commerce. Despite penalties including fines and imprisonment for non-compliance, colonies often resisted these reforms.

The Board of Trade's oversight proved particularly challenging in Massachusetts, where you'd have found three distinct currency types circulating simultaneously, requiring merchants to maintain complex conversion charts for transactions.

London's Anti-Inflation Measures

As Parliament's control over colonial currency tightened, London launched its most aggressive anti-inflation campaign in Massachusetts during 1749.

You'll find that Britain's currency stabilization efforts included shipping two tons of Spanish silver and ten tons of British copper coins to Massachusetts, providing £183,649 sterling to redeem outstanding paper money.

London's anti-inflation strategies imposed strict regulations: you couldn't accept silver at rates higher than established values, and you'd face a £50 penalty for using other colonies' notes. This approach mirrors the Bank of England's independence granted in 1997 to promote price stability without political interference.

The reforms mandated that all debts be paid in "coined silver" at 6 shillings per Spanish dollar.

You'd see these measures reflected in the 1751 Parliamentary act, which severely restricted Massachusetts from issuing new paper money until the Revolutionary War's "Soldier's notes" of 1775.

Colonial Legacy in Modern Currency

The monetary foundations laid by Massachusetts through its Pine Tree Shillings and pioneering paper currency continue to influence America's modern financial system, particularly in how you'll notice the ongoing balance between paper and metallic money.

You can trace today's decimal-based U.S. dollar directly to the colonial experience with Spanish dollars and their "pieces of eight," which proved more practical than the British sterling system. Understanding these historical connections helps develop critical economic thinking through hands-on examples.

Massachusetts's struggle with paper currency value and inflation in the 1700s established critical precedents you'll recognize in modern Federal Reserve policies, including the careful regulation of money supply and the maintenance of public trust in currency.

Early American Money Foundations

Massachusetts' groundbreaking decision to issue paper currency in 1690 laid the foundation for America's modern monetary system. When colonial spending demands increased during King William's War, the province became the first in the Western World to authorize paper money.

You'll find that this currency gained immediate acceptance, with notes valued at par with Spanish silver coins, using the £sd system where one pound equaled 20 shillings. This early success would later inspire the Continental Congress to issue its own paper currency in 1775.

You should understand that this pioneering move wasn't without challenges. The system required careful management of conversion rates, as six Massachusetts shillings equaled one Spanish dollar.

While inflation later forced multiple revaluations into Old, Middle, and New Tenor notes, this experimental phase proved vital. It established essential principles for currency issuance that would later influence the Continental Congress and ultimately shape the U.S. dollar's development.

Paper Versus Metal Debate

Fierce debates over paper versus metal currency dominated colonial Massachusetts' economic landscape, reflecting a broader struggle that would shape American monetary policy for centuries to come.

You'll find that Massachusetts' 1690 paper money innovation emerged from practical necessity, as coin shortages had forced colonists to rely on alternatives like bullets and seashells.

The benefits and drawbacks of each currency type became clear in historical context. While paper money offered flexibility and helped finance military expenses, it faced depreciation challenges, with multiple reissues needed. Early colonial trade relied heavily on Wampum and beaver pelts before the transition to paper currency.

Metal currency, particularly the pine tree shillings, provided stability but remained scarce. The mint's closure in 1682 further complicated matters.

Yet Massachusetts' experiment with paper currency proved remarkably resilient, with inflation remaining relatively controlled during Queen Anne's War despite substantial currency expansion.

Value Through The Ages

Tracking colonial Massachusetts' currency values reveals a complex evolution marked by successive adjustments and reforms.

You'll find that the initial 1690 rate of 6 shillings per Spanish silver dollar didn't hold, as currency depreciation took its toll. By 1737, inflation impact had driven the exchange to 22s6d per dollar, forcing the colony to introduce "Middle Tenor" money at triple the old value. The Currency Act of 1764 severely restricted colonial currency production, further destabilizing Massachusetts' monetary system.

The situation grew more complex when "New Tenor" notes emerged in 1742 at four times the original rate.

Conclusion

Your journey through Massachusetts' early monetary system reveals complexities that, like layers of sedimentary rock, tell a deeper story of colonial economics. You've seen how paper bills, metallic coins, and complex trade networks shaped the Commonwealth's financial evolution. Through British reforms and local innovation, you'll recognize that Massachusetts' currency experiments laid critical groundwork for America's modern monetary system.

Interesting read! Just wondering, wouldnt the barter system be more significant to early Massachusetts than metallic coins? Curious to know how paper money even gained acceptance back then.

Great read! But arent we missing the elephant in the room – how the fluctuating value of old Massachusetts currency impacted early trade methods? Lets dig deeper into that.

Interesting read, but shouldnt the article also cover how old currency value compared to todays economy? Just a thought.

Interesting article, but did early Massachusetts barter trade influence the design of their first paper money, any thoughts?

Interesting read! But, were metallic coins and paper money ever in circulation together at some point in Massachusetts history?