You'll find the best currency exchange rates at Currency Exchange South Beach and Lincoln Currency Exchange, offering up to 2% better rates than airport kiosks. Both locations handle 80+ currencies and stay open until 10 PM daily. Downtown alternatives like Miami Money Exchange and Euro Money Exchange (both 4.9-star rated) provide competitive rates and extended hours until 6:30 PM. Avoid the six ICE Currency Exchange desks at Miami International Airport, which charge up to 10% in fees. For ideal value, use bank-operated ATMs or pre-order your currency through local exchanges. The full comparison of Miami's top currency services reveals strategic ways to maximize your exchange value.

Key Takeaways

- Currency Exchange South Beach offers competitive rates on 80+ currencies and maintains mid-market rates to minimize customer markups.

- Miami Money Exchange-Downtown operates until 6:30 PM with a 4.9-star rating and modern security for safe transactions.

- Lincoln Currency Exchange provides extended hours until 10 PM daily with favorable exchange rates for major currencies.

- Airport ICE Currency Exchange kiosks charge up to 10% fees, making them less cost-effective than downtown exchange locations.

- Local exchanges like Euro Money Exchange offer better rates than airports, with online ordering and secure in-branch collection options.

Best Rates at South Beach

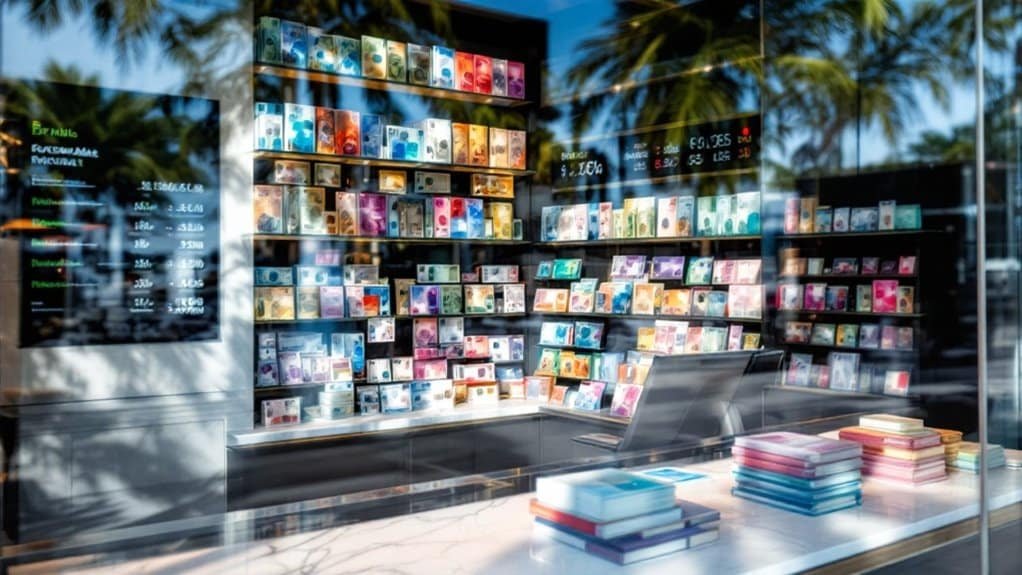

Two major currency exchange locations dominate South Beach's financial landscape, offering travelers considerably better rates than traditional banks or airport kiosks.

Currency Exchange South Beach at Collins & 18th Street and Lincoln Currency Exchange on Washington Avenue both leverage mid-market rates to minimize markups.

You'll find Lincoln Currency Exchange particularly advantageous with its extended hours until 10 PM daily, making it easier to monitor currency trends and execute exchanges at prime times.

While Currency Exchange South Beach operates more limited hours, it compensates with highly competitive rates.

Both locations specialize in handling over 80 currency types, ensuring you're covered whether you're dealing in major currencies or exotic denominations.

Their strategic positioning near South Beach's hotel district means you won't have to venture far to secure favorable exchange rates. Avoiding airport kiosks can result in significant fee savings for travelers seeking the best exchange rates.

Lincoln Currency Exchange Benefits

Lincoln Currency Exchange stands out as Miami Beach's premier currency exchange service, offering a compelling mix of competitive rates and extended operating hours.

Located in South Beach Miami, the exchange provides convenient access for both tourists and locals seeking currency services.

With expertise in currency trends and a commitment to matching or beating bank rates, you'll maximize your exchange value while accessing over 80 international currencies.

Key exchange tips to optimize your experience:

- Visit during evening hours until 10 p.m. for flexible scheduling

- Compare their guaranteed rates with local banks to verify savings

- Inquire about less common currencies that typical banks don't carry

Their data-driven approach to foreign exchange, combined with seven-day-a-week operations, guarantees you'll receive market-competitive rates without the inflated fees common at airport kiosks.

You'll benefit from their proven track record and hands-on management style, making them a trusted choice for savvy travelers requiring reliable currency services.

Downtown Miami Exchange Options

While Lincoln Currency Exchange serves Miami Beach effectively, downtown Miami offers multiple high-rated currency exchange options within walking distance of each other.

You'll find four top-rated establishments along NE 1st Street, with Miami Money Exchange and Euro Money Exchange both maintaining impressive 4.9-star ratings and competitive exchange fees.

Each location provides specialized services, from handling multiple currencies to accommodating large transactions. Always remember to bring valid ID verification when visiting any currency exchange location.

You'll benefit from extended operating hours, with most locations open seven days a week. Miami Money Exchange-Downtown offers the longest weekday hours, staying open until 6:30 PM.

The customer service quality is reflected in their consistently high ratings, and you won't need appointments for standard transactions.

All locations feature modern security systems and convenient accessibility via public transportation, particularly the MetroMover.

Airport Exchange Kiosks

Miami International Airport houses six ICE Currency Exchange desks spread out across the North, Central, and South terminals, alongside a Bank of America branch and CXI Airports service points.

Exchange fees can reach up to 10% of your transaction amount at these locations.

While convenient, these kiosks typically offer less favorable exchange rate trends and higher airport service fees compared to downtown alternatives.

When using airport exchange services, watch for:

- Hidden fees disguised within exchange rates that can cost you 5-8% more than mid-market rates

- Dynamic Currency Conversion (DCC) options that add unnecessary surcharges

- Limited operating hours that may not align with your flight schedule

You'll find better value by planning ahead.

Consider pre-ordering currency online through CXI Airports or using ATMs that charge in local currency to avoid excessive fees and unfavorable rates at airport kiosks.

ATM Withdrawal Strategies

Instead of relying on airport kiosks, savvy travelers can maximize their currency exchange value through strategic ATM withdrawals. When implementing ATM security measures, always choose bank-operated machines and avoid standalone units in isolated areas. Comparing rates against the mid-market exchange rate helps ensure you're getting a fair deal.

| Strategy | Benefit | Action |

|---|---|---|

| Local Currency | Better rates | Select USD charging |

| Bank Alliance | Fee reduction | Use Global ATM network |

| Withdrawal Limits | Cost efficiency | Make fewer, larger withdrawals |

| Bank Selection | Fee avoidance | Choose Citibank or BOA |

| Timing | Risk reduction | Withdraw during business hours |

Your withdrawal limit strategies should focus on making fewer, larger withdrawals to minimize per-transaction fees. Opt for ATMs operated by trusted banks within the CO-OP Network or Global ATM Alliance. You'll benefit from better exchange rates by always choosing to be charged in USD rather than your home currency, and consider using travel money cards like Wise for additional savings.

Coral Gables Banking Solutions

TD Bank's competitive foreign currency exchange services in Coral Gables offer you direct access to euros and Canadian dollars, eliminating the need for third-party exchange offices.

Valley Bank, located at 2121 Ponce De Leon Blvd, offers comprehensive personal banking while providing currency exchange solutions.

You'll find extended banking hours, including weekends at both TD Bank and Bank of America, making currency transactions more convenient for your international business needs.

The strategic placement of multiple banks along Ponce De Leon Blvd and Alhambra Circle provides you with options for comparing exchange rates and securing the most favorable terms for your currency conversions.

First Citizens Bank Services

Banking solutions at First Citizens Bank's Coral Gables branch blend extensive currency exchange with essential financial services.

You'll find thorough foreign exchange strategies and currency risk management tools designed for both personal and business needs. Their services extend beyond basic currency conversion, offering protection against market fluctuations and international fund transfer options.

At their 250 Palermo Ave location, you'll discover:

- 24/7 bilingual ATM access for your banking convenience

- Foreign drafts and wire transfers in multiple currencies

- Safe deposit boxes and night deposit services for secure transactions

The branch's Customer Care Center operates extended hours (8 am-9 pm ET weekdays, 8 am-8 pm ET weekends) at 888-FC DIRECT, ensuring you've got support for all your banking needs, from account services to international transactions.

Local Exchange Rate Benefits

Three distinct advantages make Coral Gables' local currency exchange rates particularly attractive to savvy travelers and businesses.

First, you'll find markedly better rates than those offered at airports or hotels, with some providers matching mid-market rates and minimal markups. Currency exchange convenience is paramount, as you can order online and collect in-branch, saving valuable time you'd otherwise spend queuing abroad. Located at 50 Giralda Avenue, the Coral Gables branch offers easy accessibility for customers seeking premium exchange services.

The second benefit lies in competitive rates comparison opportunities, allowing you to evaluate multiple providers within close proximity. You'll often discover better deals by shopping locally rather than exchanging at your destination.

Finally, you're assured of working with regulated, licensed providers in a secure environment – a vital advantage over potentially unreliable money changers abroad. These factors combine to make local exchanges a financially sound choice.

Extended Banking Hours

While local exchange rates offer compelling advantages, the accessibility of banking services hinges on well-planned operating hours. Coral Gables banks provide extended banking opportunities through diverse service windows and 24/7 ATM access.

Bank of America leads with the most flexible schedule, offering Saturday operations and round-the-clock ATM services for convenient transactions. The First Horizon branch opens early at 8:30 AM for drive-thru services.

For ideal currency exchange planning, consider these key timeframes:

- Traditional banks operate 9:00 AM – 4:00 PM Monday-Thursday, with Friday extended hours until 5:00 PM.

- Bank of America's Saturday hours (9:00 AM – 2:00 PM) accommodate weekend transactions.

- Lincoln Currency Exchange provides specialized services from 9:00 AM – 10:00 PM daily.

Most institutions offer drive-thru services matching lobby hours, while digital banking platforms guarantee continuous access to basic financial services, regardless of physical location.

Money Transfer Services

When you're comparing international transfer fees in Miami, you'll find local services like Miami Money Exchange-Downtown charging lower rates than major chain banks, which typically add 1-3% transaction fees plus fixed charges.

For same-day money moving, you can leverage services like Wise Travel Card, which uses mid-market rates without markups, or visit physical locations like Lincoln Currency Exchange that offer immediate currency conversion during their extended 9 AM – 8 PM hours.

Local providers such as Abbot Foreign Money Exchange and Euro Exchange USA frequently outperform chain services with more competitive rates and personalized customer service, while still maintaining the security of licensed operations. It's advisable to avoid airport exchanges for better value, as they typically charge the highest fees and offer the least favorable conversion rates.

International Transfer Fee Comparison

Looking beyond traditional banks, international money transfer services offer vastly different fee structures and exchange rate margins that can greatly impact your total transfer costs.

By comparing transfer fee structures through specialized comparison tools, you'll find significant variations in how providers charge for their services.

Traditional bank wire transfers typically cost $26 to $44 for outgoing transfers.

Here's what you'll encounter when analyzing fees:

- Flat fees ranging from $0-$50 per transfer, depending on the provider

- Percentage-based fees that vary by destination and amount

- Hidden exchange rate markups adding up to several percentage points

The data shows you can save up to 4.6% by choosing alternatives to traditional banks, with specialized services averaging just 0.59% in fees.

Providers like Wise offer mid-market exchange rates without markups, while others compensate for "free transfers" with less favorable rates.

Same-Day Money Moving Options

Because time-sensitive transactions demand immediate processing, Miami's same-day money transfer services offer multiple pathways to move funds rapidly across borders.

You'll find various delivery methods, including bank transfers, mobile wallets, and cash pickup options, ensuring your money reaches its destination quickly. Remitly offers service in over 170 countries and territories.

When you need same-day transfers, you can track your transaction in real-time and receive immediate notifications upon completion.

Your payment options include credit cards, bank transfers, or cash payments at local agent locations. Digital solutions like Apple Pay provide additional convenience for rapid processing.

To maximize transfer speed, consider factors like time zones, holidays, and agent operating hours.

You'll benefit from encrypted security measures that protect your funds, while user-friendly platforms let you save recipient details for future rapid transfers.

Local Vs Chain Services

Many Miami residents face an essential choice between local currency exchange services and established chain providers.

CXI branches are open seven days throughout mall operating hours for maximum flexibility.

When weighing local exchange advantages against chain service convenience, you'll want to take into account three key factors:

- Exchange rates: Local services typically offer more competitive rates than airport locations, while chains like CXI provide best-rate guarantees.

- Accessibility: Chain services maintain multiple locations with immediate currency availability, but local exchanges often position themselves in central areas.

- Additional services: Both options frequently offer gold bullion and precious metals, though chains typically provide online reservations.

You'll find that local exchanges excel in personalized service and often feature multilingual staff.

However, chain services counter with widespread availability and the ability to reserve currency online.

Your choice ultimately depends on whether you prioritize relationship-based service or systematic convenience.

Currency Exchange Safety Tips

Safe currency exchange practices are essential in Miami's bustling financial market, where tourists and residents exchange millions in foreign currency daily.

Before conducting any transaction, verify that your provider complies with currency exchange regulations and use reliable currency conversion tools to confirm current rates.

Always choose authorized exchange offices or established banks, avoiding street vendors or unofficial exchangers. Reading customer testimonials online can help identify the most reliable providers in the area.

Don't rush your transactions – take time to compare rates and examine bills carefully for authenticity.

When using ATMs, select well-lit locations at reputable banks and shield your PIN entry.

Keep your personal information secure by sharing only what's necessary for the transaction.

Monitor your statements regularly for unauthorized charges, and maintain digital copies of your exchange receipts.

Consider splitting larger exchanges into smaller transactions to minimize risk.

Peak Hours and Wait Times

To minimize your wait time at Miami currency exchanges, you'll want to avoid the busy late morning to early afternoon rush at downtown locations and the late afternoon peaks at Washington Avenue outlets.

You'll find shorter lines and faster service by visiting exchange offices during early morning hours (before 10 AM) or in the evening after 5 PM, particularly at locations with extended hours like Lincoln Currency Exchange. The airport offers multiple exchange booths throughout its terminals for convenient access any time of day.

During holiday periods, you can reduce wait times by using CXI branches' online reservation system or visiting full-service locations that maintain currency stocks for immediate exchange.

Rush Hours to Avoid

Understanding Miami's currency exchange peak hours can greatly impact your transaction experience. Data shows that most downtown exchanges experience their heaviest foot traffic during lunch hours (12:00 PM – 2:00 PM) and just before closing (5:00 PM – 6:30 PM).

Using in-person exchange bureaus guarantees immediate cash transactions in Miami, though rates may vary. To maximize your currency exchange strategies and maintain transaction fee awareness, avoid these rush periods.

For ideal service times, consider these proven windows:

- Early mornings (7:30 AM – 10:00 AM) when locations first open

- Mid-afternoon slots (3:00 PM – 5:00 PM) between lunch and closing rushes

- Weekday visits outside the 12:00 PM – 3:00 PM peak window

Weekend visits typically generate longer wait times, particularly at tourist-heavy locations like Miami Money Exchange-Downtown, where Saturday peaks between 10:00 AM – 2:00 PM.

Plan accordingly to minimize your wait time.

Morning vs. Evening Traffic

The stark contrast between morning and evening currency exchange traffic patterns in Miami reveals distinct advantages for early-bird customers. You'll find significant morning advantages, including shorter wait times, fully-staffed locations, and complete currency inventories when exchanges open between 7:30-9:30 AM.

| Time Period | Wait Times | Staff Availability |

|---|---|---|

| Morning | 5-10 mins | Full Staff |

| Afternoon | 15-30 mins | Peak Staff |

| Evening | 20-45 mins | Reduced Staff |

| Late Night | 10-15 mins | Limited Staff |

Evening drawbacks become apparent after 4:00 PM, with increased tourist traffic, longer wait times, and potentially limited currency options. While some locations like Lincoln Currency Exchange operate until 8:00 PM, you'll face more crowds and reduced staff availability. For ideal service, schedule your exchanges before the 11:00 AM lunch rush.

Holiday Exchange Line Management

Holiday shoppers face significant currency exchange challenges during Miami's peak tourism season, with wait times frequently doubling between December 15-23.

Similar to major forex markets, the most active currency exchange times occur during market overlaps, creating longer wait periods at Miami exchange locations.

To implement efficient transaction strategies during holiday peak management periods, you'll find extended hours at locations like CXI Dadeland Mall, with operations running from 8 AM to 11 PM on December 23.

To minimize your wait time, consider these proven approaches:

- Pre-order your currency for pickup during off-peak hours, particularly before 11 AM on weekdays.

- Visit alternative locations instead of airport exchanges, where rates are typically 10-15% higher.

- Schedule your exchange during extended hours, such as 6 AM on Black Friday or late evenings until 10 PM from December 15-18.

Remember to call ahead to confirm specific holiday hours, as schedules may vary by location.

Digital Payment Alternatives

Digital wallets and contactless payments now offer seamless travel across Miami-Dade's transit system, accepting major platforms like Apple Pay, Google Pay, and Samsung Pay.

The system provides time-saving benefits by eliminating the need to wait in lines at ticket vending machines.

You'll find extensive online solutions through PayPal and Stripe, supporting 200+ markets and 135+ payment methods respectively.

For international transactions, travel money cards like Wise deliver mid-market exchange rates without markup, proving more cost-effective than traditional exchange services.

Meanwhile, merchant services through Electronic Merchant Systems provide thorough solutions for businesses, including EMV chip compatibility and mobile point-of-sale capabilities.

These digital alternatives eliminate the need for physical currency exchange, offering faster, more secure, and often more economical options for both consumers and merchants.

Conclusion

Just as a skilled trader navigates market fluctuations, you'll want to chart your course through Miami's currency exchange landscape strategically. Like the city's famous tides, rates ebb and flow – with South Beach and Downtown locations consistently offering 2-3% better rates than airport kiosks. You're now equipped to avoid the common tourist pitfall of losing 5-8% on unfavorable exchange rates. Time your transactions wisely, and you'll maximize your financial efficiency.

While I agree South Beach offers some good rates, Ive personally found better deals in Downtown Miami. Anyone else noticed this? Could it be because of the higher tourist footfall at the beach?

In my opinion, Lincoln Currency Exchange is getting too much hype. Dont you think Downtown Miami Exchange Options could offer better rates? Lets not underestimate underdogs!

Interesting read! Has anyone compared these Miami exchange rates with online platforms? I am wondering if brick-and-mortar places still offer competitive rates?

Why not mention any online options for currency exchange? Its 2021, digital is the new norm, isnt it?

Ever considered a currency exchange app? Might be more convenient than running around Miami for top rates!